6/20/2020

Victims Trust Fund Approved As PG&E Bankruptcy Ends

After roughly 17 months in bankruptcy, and following tragic fires in Sonoma and Napa County’s in the fall of 2017 and similarly devastating and fatal fires in Butte County in 2018, United States bankruptcy court charge Dennis Montalbano signed a final order approving a plan of re-organization on Saturday, June 20, 2020 bring in to an end the largest bankruptcy in United States history. Read More

11/10/19

PG&E Plan to Pay Insurance Claims in Cash Hurts Bankruptcy Talks

Following Governor Newsom’s demand that efforts be redoubled to bring the PG&E bankruptcy to an end through a negotiated or mediated settlement, the Walkup fire litigation team headed by Mike Kelly, Khaldoun Baghdadi, Andrew McDevitt and Max Schuver has been working diligently with the Official Committee of Tort Claimants in the Bankruptcy litigation to find a path out of Bankruptcy so that fire victims can be paid, helping them rebuild their lives. A major stumbling block to resolution has been an unfair deal struck between PG&E and insurance companies that unfairly treats insurance companies better than homeless victims and depletes the cash available for victims to rebuild. This fact has not been lost on the financial world, as evidenced by this article in the November 8, 2019 Wall Street Journal: “PG&E Plan to Pay Insurance Claims in Cash Hurts Bankruptcy Talks: An $11 billion cash payout would push victims to take stock deal”

“PG&E Plan to Pay Insurance Claims in Cash Hurts Bankruptcy Talks: An $11 billion cash payout would push victims to take stock deal”

As published in Wall Street Journal

By Andrew Scurria, Peg Brickley and Erin Ailworth

An $11 billion settlement of insurance claims tied to PG&E Corp. ’s alleged responsibility for California wildfires is emerging as an impediment to a potentially broader deal to end the utility’s bankruptcy, according to people familiar with the matter.

The proposed payoff to hedge funds and insurance companies is coming under pressure as victims of the wildfires bargain for better treatment by PG&E, the people said.

In September, the company signed a settlement proposal that would pay $11 billion in cash compensation for what insurers paid out for damages caused by wildfires linked to PG&E equipment.

If approved by the court overseeing PG&E’s bankruptcy, the deal could tie up much of the free cash the company will have as it exits bankruptcy. Some of the cash would go to insurance carriers themselves, repaying insured losses stemming from the wildfires. Much of it would go to hedge funds that bought insurers’ claims against PG&E at discounts, usually paying less than 50% of the face value.

And, people who lost homes and loved ones to blazes that have been linked to the utility’s aged equipment are more likely to receive shares in the restructured company as compensation, rather than cash.

That prospect is not sitting well with lawyers for fire victims, who already are being pressured to take less than the $54 billion they believe their clients are owed. Market participants are also questioning whether PG&E can afford to stick with the cash payout for claims when the utility may be swamped with yet more wildfire damages.

The clash between fire victims and insurance companies moved into the open Friday, when the official committee representing victims filed court papers challenging the proposed settlement and asking the bankruptcy judge to decide whether the two groups of creditors are on equal footing in the bankruptcy case. Fire victims say that, by law, they should be paid before the insurance companies.

“It is time to call this settlement what it is: a mistake,” lawyers for the fire victims wrote. “The debtors have given away all their cash and placed the wildfire victims in a position of full risk in this case.”

Prices on insurance claims climbed after the insurance settlement but have since softened. The market now believes the insurance settlement, which requires court approval, is at “a high degree of risk of becoming unsustainable,” said Vladimir Jelisavcic of claims-trading platform Cherokee Acquisition.

Insurers and investors that bought insurance claims are acting as a group in the bankruptcy case, advocating for approval of the settlement. Friday, a spokesman for the group issued a statement saying they had “made the largest concession of any creditor group in the PG&E bankruptcy cases to date. By agreeing to nearly halve our recovery on our claims against PG&E arising from billions of dollars of insurance claims paid to California wildfire victims, the group has been a major facilitator of a comprehensive solution.”

Fire victims, bondholders, PG&E and its owners are negotiating behind closed doors under the supervision of a mediator who is pushing for a broad consensus on the best way forward.

PG&E’s opening offer to fire victims is $8.4 billion, an amount that includes $7.5 billion for individual wildfire claimants, and $900 million for emergency services providers. A rival chapter 11 exit strategy put forth by bondholders and wildfire victims themselves, provides for fire damage payments of $13.5 billion, with payment in stock and cash.

In a regulatory filing on Thursday, PG&E acknowledged that settlement talks may result in a revised plan that offers fire victims an amount closer to the $13.5 billion bondholders are offering.

The sticking point in negotiations is the form of payment, according to people with knowledge of the talks.

The company has said the insurance settlement represents a recovery of about 55% on insurance claims. Critics of the deal disagree, and are pointing to payout figures that indicate insurers, and investors that bought insurance claims at a discount, are in for a relative windfall if the settlement is approved.

With holdings of more than $6 billion, Seth Klarman’s Baupost Group is the largest holder of insurance claims. The Boston hedge fund is also one of PG&E’s largest shareholders, owning 24.5 million shares.

It’s not known how much Baupost paid, but the data available indicate the hedge fund could make hundreds of millions of dollars in profit from its PG&E insurance claims, more than enough to offset the losses it has taken on the utility’s flagging stock.

In March, when Baupost reported its holdings in court filings, its stake in PG&E’s stock was worth nearly $467 million. At Thursday’s closing price, Baupost’s stock in PG&E was worth less than $147.5 million.

Baupost declined to comment on the insurance settlement. Judge Dennis Montali is scheduled to hold a hearing on it next week in the U.S. Bankruptcy Court in San Francisco.

The insurance settlement has been controversial from the start. Wildfire claimants argued it is unwise for PG&E to bind itself to an $11 billion cash payout without knowing what the full amount of damages stemming from the blazes will be.

Baupost has said in court papers the proposal helps wildfire claimants and would guard against PG&E’s insolvency by nearly halving a potential $20 billion insurance claim.

Failure to get to a chapter 11 plan agreement with wildfire claimants could be disastrous for PG&E, which faces a June 30, 2020, deadline to exit bankruptcy if it wants to participate in a state wildfire fund that would cushion it against future losses.

9/23/19

PG&E Bondholders Ally with Wildfire Victims

PG&E bondholders have created a substantial challenge to the proposed bankruptcy plan of the California utility company responsible for causing the devastating wildfires that took nearly dozens of lives and ruined entire towns.

Previously, on September 9, 2019, PG&E officially provided its proposed bankruptcy reorganization plan to the U.S. Bankruptcy Court in San Francisco. The plan specifically capped wildfire victims’ claims at $8.4 billion and capped reimbursing insurers that would pay victims’ claims at $8.5 billion. Additionally, only $1 billion was offered for reimbursement to local governments.

The devastation of this wildfire represented 26% of all wildfire losses in the state of California. Many wildfire victims felt shocked by this insufficient proposal from PG&E. Wildfire victims attorney Mike Kelly stated, “It’s not in any way, shape or form satisfactory or fair.”

However, in a recent turn of events, PG&E bondholders have now formed an alliance with the victims of the wildfires to propose a competing Chapter 11 bankruptcy reorganization plan, according to the Wall Street Journal. The legal papers were filed by a group of PG&E bondholders and the official committee that represents the victims of the wildfires. These groups united to request that the court allow them the ability to officially and legally propose a separate and competing Chapter 11 plan that would increase and improve compensation for fire victims up to $24 billion dollars, nearly tripling the amount proposed by PG&E.

PG&E has stated that their position is that bondholders would be paid in full under its chapter 11 plan. Therefore, PG&E argues that bondholders have no legal right to vote on the terms. Bondholders disagree and argue that they are being denied their contract rate of interest as well as premiums they say are due on the debt.

While the bondholders must face the obstacle of court permission to formally file the separate Chapter 11 plan and win, this announcement by bondholders places substantial pressure on PG&E to reconsider their original bankruptcy proposal to the fire victims in California.

9/20/19

The Case Against PG&E for the Tubbs Wildfire

The Walkup Firm continues to fight on behalf of Tubbs fire victims, led by Mike Kelly, a partner at the firm. Mike and other attorneys will use their findings to argue that PG&E is in fact to blame for the Tubbs fire, in spite of the CAL FIRE report maintaining that the fire was related to issues with private electrical equipment on private property.

Speaking of the supposed location of the fire’s origin from the CAL FIRE report, attorney Mike Kelly told ABC10 that “Cal Fire did not find, actually, a component, a wire, a pole— did not find any physical evidence consistent with its suggestion that the fire started there.”

The Tubbs wildfire case against PG&E will include two photos of damaged copper wires (shown below), believed to be evidence of a spark on a power line conductor located near but not on the private property mentioned in CAL FIRE’s report. The case will also demonstrate that the security footage video from the nearby Bennet Lane Winery shows a bright spark with a 9:20pm timestamp, which may in fact be the arcing that caused the damage on these two lines and led to the genesis of the Tubbs fire. CAL FIRE’s report makes mention of the Bennett Lane Winery security video, but it does not mention the two lines with evidence of arcing.

Wind direction will also be brought up as part of the case. Cal Fire maintains that strong winds were blowing toward the south and west that night. If this were true, when considering the burn area of the Tubbs fire, some of that fire would have had to spread against the wind.

“Fires do not go downhill into a wind,” Kelly told ABC10. He went on to say: “CAL FIRE basically suggested that from an unknown source in an unknown place, with an unknown component, they say that the fire started on private property and then burned downhill into the face of 70 mph winds.”

The trial for the case will start on January 7, 2020 in the San Francisco Superior Court. For those affected by the Tubbs wildfire, the October 21, 2019 deadline for filing a claim is fast approaching. We urge all Tubbs fire victims to file a claim immediately. Those who don’t file a claim will not have the opportunity to seek recovery for damages if PG&E is ultimately shown to be at fault for the fire. If you or someone you know was impacted by the Tubbs wildfire, contact our office immediately for help in filing your claim.

9/12/19

PG&E’s Wildfire Proposal Plan Shortchanges Victims, Protects Shareholders

PG&E, the California utility company responsible for causing the devastating wildfires that took nearly dozens of lives and ruined entire towns, filed for Chapter 11 bankruptcy in January 2019. The wildfire damage estimates are expected to reach $30 billion dollars and victims are anxiously awaiting to hear how their claims will be addressed by PG&E.

On Monday, September 9, 2019, PG&E officially provided its proposed bankruptcy reorganization plan to the U.S. Bankruptcy Court in San Francisco. “Under the plan we filed today, we will meet our commitment to fairly compensate wildfire victims and we will emerge from Chapter 11 financially sound and able to continue meeting California’s clean energy goals,” said Bill Johnson, PG&E Corporation’s Chief Executive Officer, and President.

However, upon closer inspection, the proposed PG&E plan included only $17.9 billion for all claims related to the catastrophic destruction stemming from the California wildfires nearly two years ago.

The plan specifically caps wildfire victims claims at $8.4 billion and caps reimbursing insurers that paid victims’ claims at $8.5 billion. Additionally, only $1 billion is offered for reimbursement to local governments. Furthermore, PG&E did not offer any sacrifices or possible payouts from its bondholders or shareholders.

Michael Kelly, partner at Walkup, Melodia, Kelly & Schoenberger working on behalf of the wildfire victims, was shocked by this insufficient offer. Speaking of the PG&E proposal Kelly told the Reuters news organization “It’s not in any way, shape or form satisfactory or fair”. Kelly has previously stated that the magnitude of this wildfire event cannot be understated and that this particular wildfire represented 26% of all wildfire losses throughout the state of California.

With this proposal, PG&E shortchanges the wildfire victims of their right to compensation, while at the same time rewarding its bondholders and shareholders. Although their negligence caused unprecedented destruction in California, this proposal would allow PG&E owners to profit for decades to come, while victims struggle to rebuild their lives, literally from the ashes.

While it comes as no surprise that PG&E is attempting to limit the amount of their financial obligations with respect to the wildfires, they have admitted that their equipment and their negligence was a direct cause of these wildfires that devastated communities and people’s lives.

Critics of PG&E’s proposal believe that the court should summarily reject it as insufficient to repay and restore victims of the company’s negligence.

PG&E must now file a detailed reorganization plan with the U.S. Bankruptcy Court by September 29, 2019. PG&E will ultimately need to win approval for a reorganization plan from U.S. Bankruptcy Judge Dennis Montali, who has previously indicated he was gravely concerned about protecting the public trust and ensuring that the optics of this case illustrate that the victims are compensated adequately for their losses.

8/21/19

Walkup Melodia Partner Michael Kelly Makes Compelling Arguments Before the Court on Behalf of Wildfire Victims

On August 14, 2019, U.S. Bankruptcy Judge Dennis Montali heard arguments regarding the Tubbs fire, started on October 8, 2017, that devastated homes, towns and took nearly two dozen lives. PG&E, the utility company responsible for causing the fires, filed for Chapter 11 bankruptcy in January 2019, as the estimate from the wildfire damages neared $30 billion dollars. PG&E argued that all lawsuits against the company by wildfire victims should cease, and any claims should be consolidated as part of that bankruptcy.

Although Cal Fire determined that it was private property owners’ equipment that started the wildfire, lawyers for the wildfire victims insist that there should be a jury trial instead, in order to prove that the investor-owned utility is responsible for the wildfire.

Mike Kelly, a partner at Walkup, Melodia, Kelly & Schoenberger who works on behalf of the wildfire victims, stated that in this unprecedented case, the victims’ claims were too significant to be resolved in closed-door negotiations, emphasizing that this particular wildfire represented 26% of all wildfire losses throughout the state of California. The victims are requesting a fast-tracked civil trial with a small pool of plaintiffs.

“Those people have the right to have the light of day shined on the facts and shined on PG&E’s behavior,” Kelly said.

Time is not on PG&E’s side, as Governor Gavin Newsom and the California Legislature have imposed a June 30, 2020 deadline for the company to restore all claims, finish bankruptcy proceedings and thus participate in the $10.5 billion wildfire insurance fund. An attorney for PG&E argued fiercely against a civil trial, as a jury trial may not be resolved prior to the bankruptcy case, and therefore eliminate the possibility of participating in the fund. Additionally, the PG&E attorney argued that the bankruptcy court would provide the quickest resolution to the matter and that a jury trial would unfairly include an inaccurate sampling and a non-representative group of victims.

However, Kelly urged that the Tubbs Fire trial is imperative to expose the true culpability of PG&E’s actions regarding the inferno. A jury trial would demonstrate an air of fairness to the victims that are the sole reason PG&E needed to file for bankruptcy in the first place.

“We believe that from a justice and transparency point of view … the people who suffered these losses are entitled to have this trial be public,” Kelly said.

During the three hours of arguments, Judge Montali seemed to echo Kelly’s sentiment, continually returning to the important foundation of public trust. The optics of determining such a staggering case outside of a jury could prove devastating to public trust. “Does it appear fair? Does it appear fair if there isn’t a jury?” Montali said.

Judge Montali indicated he would have a written option by Friday, August 23, 2019, or Monday, August 26, 2019. His ruling will likely determine how this significant case moves forward, and how the victims of this wildfire will be compensated.

7/17/19

5 Things You Should Know About PG&E’s Legal Notice

Following the devastating Northern California wildfires that left thousands of families without homes, killed as many as 144 victims, razed the town of Paradise, and devastated communities throughout Northern California, PG&E — the utility company responsible for starting the blazes — filed for bankruptcy. As a result, the claims against the company by fire victims were consolidated in bankruptcy court.

After requesting and obtaining a “BAR Date” to limit the time during which wildfire reimbursement claims can be filed against it, PG&E has now mailed out thousands of legal notices to fire victims. However, these legal notices may be confusing to some recipients. By completing these forms incorrectly, or filling out the wrong form, a fire victim may inadvertently reduce or eliminate their ability to recover some types of damages.

Here are some important things you should know:

- If you receive a “Notice of Deadline for Filing Fire Related Proof of Claim Forms” and a “Proof of Claim” in the mail from PG&E, do not attempt to answer questions you do not understand.

- If you lost your home or property or have been left without adequate funds to rebuild and you have a lawyer already DO NOT COMPLETE the form – your attorney will do this for you.

- If you do not have an attorney or you have friends or family that do not have an attorney, contact us at to 415-981-7210 answer any questions about your loss before filing a proof of claim.

- YOUR PROOF OF CLAIM WILL CONTROL ANY RECOVERY AGAINST PG&E. MAKE SURE IT IS FILLED OUT CORRECTLY. CALL US AT 415-981-7210 TO UNDERSTAND WHAT IS HAPPENING IN THE BANKRUPTCY CASE. MAKE SURE YOU ARE PROTECTED.

- Deadline for filing a claim is October 21st, 2019.

The Walkup firm is representing victims in the Bankruptcy. We are filing claims for more than 600 CAMP, TUBBS, ATLAS, and NORTH BAY wildfire victims. For those who have put off hiring a lawyer, we can help. Victims who don’t file in time will lose all their legal rights. If you lost property or sustained injury YOU HAVE LEGAL RIGHTS TO RECOVER AGAINST PG&E. Contact us now at (415) 981-7210.

5/23/2019

PG&E Bankruptcy Update

Following the catastrophic wildfires that ravaged Northern California in October 2017, the Chair of the Judicial Council coordinated the lawsuits alleging PG&E was to blame in the Superior Court for the County of San Francisco. On March 6, 2018, Judge Karnow appointed Michael Kelly and Khaldoun Baghdadi, of Walkup, Melodia, Kelly and Schoenberger, as co-lead and co-liaison counsel respectively. The Court appointed Mr. Kelly and Mr. Baghdadi to leadership roles in acknowledgment of their storied careers and earned respect among the California and National Plaintiff’s Bars. For the following ten months, our firm helped lead the team that conducted dozens of depositions and discovered more than six million pages of documents.

In January 2019, in the wake of yet another unprecedented disaster caused by PG&E equipment, the Camp Fire, the utility filed for Chapter 11 bankruptcy protections. As a result, the cases in San Francisco were stayed. The planned coordination of the Camp Fire cases was halted. While Wall Street worked furiously to depress and inflate the prices of PG&E’s bonds and stock to gain greater leverage over an eventual bankruptcy settlement, our firm never ceased its efforts to obtain justice for Californians impacted by the North Bay Fires and the Camp Fire. Many of us have families and roots that were ripped up by these fires, and we refused to lay down and allow the bankruptcy system to launder PG&E’s callous indifference towards legitimate safety concerns or to allow the lives of so many to have been lost in vain. What we knew then, and what we continue to believe, is that the costs of these fires cannot be borne by those who have suffered the most. It wouldn’t be right, and it would not make us any safer.

With the help of those who have already chosen us to represent their claims against PG&E, we are developing documentation of the unimaginable losses caused by the North Bay Fires and the Camp Fire. Every single piece of information we gather from our clients regarding the loss of their homes, their belongings, their crops, and their loved ones can be used in the ongoing battle within the bankruptcy between all wildfire claimants and PG&E and Wall Street. From our continued position of leadership, we are working not only to measure the losses of our clients, but the losses across Northern California, to ensure we will not be pushed around by powerful corporate and governmental forces that may seek to return to business as usual once the spotlight of this litigation has faded.

We continue to welcome new clients who suffered losses in the North Bay Fires and those who suffered dearly in the Camp Fire. The more claims we can file in the bankruptcy against PG&E, the more force our arguments carry in court and in Sacramento, where legislators are weighing their options. In any case, we want everyone with a wildfire claim to speak with an attorney, regardless of whether they ultimately decide to pursue claims against PG&E. An educated public is our greatest weapon against PG&E’s heedless approach to the inherent dangers of electrical power distribution to our homes.

We have never stopped working for the families displaced and the businesses destroyed by these fires. The bankruptcy has shifted the battlefield, but we are still engaged in the same battle.

The Tubbs Fire Cause

Justice for those impacted by these fires means justice for EVERYONE impacted by these fires. The Cal Fire press release that accompanied the release of that agency’s Tubbs Investigation Report was shockingly misleading. In spite of the fact that the Tubbs Investigation Report, which we strongly encourage Santa Rosans and everyone to read), made no positive conclusions about the cause of the Tubbs Fire, the press release indicated that a cause of the fire had been determined, and that this cause was a private electrical system. The reports itself ignored evidence turned over to Cal Fire that calls into question it’s reductive “conclusions”. Before these cases were stayed due to the bankruptcy, PG&E waged a campaign to influence the outcome of the Cal Fire investigation, and the shaky results bear out the politics at play.

Not only does it appear impossible that the spark that started the Tubbs Fire came from a privately owned electrical system, but the fact also remains that PG&E’s poor decisions created the risk of that spark. After years of destructive electrical fires in its territory, San Diego Gas & Electric began to implement more stringent weather and fire monitoring stations, and critically, a proactive system for de-energizing power lines in areas where red flag conditions were forecast. The results were immediate and obvious. The number and severity of electrical fires throughout San Diego plummeted. The California Public Utilities Commission (CPUC) determined that all of the major utilities must implement de-energization programs.

In spite of complaints from the state legislators overseeing the utilities, PG&E was sluggish to comply. PG&E rolled out a paltry pilot number of “reclosers” that would allow it to remotely shut down a circuit’s capability to re-energize when it tripped in dangerous conditions. In spite of widely predicted red flag conditions on October 8, 2017, and the understood dangers associated with power lines running through vegetated areas like the outskirts of Calistoga, PG&E made the decision not to de-energize the lines that we KNOW fed whatever equipment sparked the Tubbs Fire. Put another way, had PG&E followed a common-sense set of guidelines for de-energizing dangerous lines, there would have been no electricity to cause the spark that started the Tubbs Fire, regardless of what equipment was involved.

As with all of the fires, it is our firm belief that holding PG&E accountable for its failures from top to bottom is the only way to make us safer. The failure of PG&E to act as it was empowered to by the CPUC to prevent the Tubbs Fire is no more excusable than its inability to keep its power lines on Atlas Peak clear of tree limbs or to replace corroded parts on the distribution towers outside of Paradise. We can expect nothing less from our electrical utility than the most passionate commitment possible to our safety, and the fight over Tubbs is a crucial part of this fight. No safety enhancements will make as big a difference as proactive de-energization. The utilities recognize this as well, and have launched the Prepare for Power Down campaign. However, actions speak louder than websites, and we have been at this long enough to know that PG&E will not act responsibly without force.

The reports in the local and national press following the Cal Fire announcement did real damage to the morale of the Santa Rosa communities who had already spent more than a year trying to put the pieces back together. We have never wavered in our conviction that PG&E is legally responsible for the Tubbs Fire, regardless of what the Cal Fire press release indicated. Those who lived in the footprint of the Tubbs Fire should contact an attorney to discuss filing a claim in the bankruptcy.

Camp Fire Cause Determination

On May 15, 2019, Cal Fire made the highly anticipated announcement that it had conclusively determined that PG&E equipment caused the Camp Fire. PG&E had already admitted in filings to its investors that this was expected. Supported by documents uncovered by our office, the New York Times published a story in March 2019 describing PG&E’s awareness of the kinds of dangers that led to the failure of the century-old Pulga tower.

In a traditional state court wildfire case against a utility, the statute of limitations would afford plaintiffs three years in which to file a lawsuit. However, in the bankruptcy context, the controlling date is called the “bar date”. This date is set by the court. All claimants must file a claim in the bankruptcy court before the bar date, or they will not be able to recover anything against PG&E.

PG&E has requested that the court set the bar date on September 16, 2019. Given that PG&E caused unprecedented destruction that displaced thousands of people and left them without the resources needed to file a claim, we are fighting along with the Official Committee of Tort Creditor Claimants to push this date back to give claimants more time to file. Nevertheless, those who lost their homes, their possessions, their livelihood, or otherwise were injured or fled the fires should contact us as soon as possible to make certain that their rights to recover for their losses do not expire.

Bankruptcy overview

The U.S. Trustee is a subdivision of the Department of Justice that oversees all bankruptcy cases in the United States. While the assigned bankruptcy judge has great power and influence over a case, there are certain aspects of the case that are the sole responsibility of the U.S. Trustee. One such aspect is the formation of official committees of creditors. The person or entity that files for bankruptcy protection is known as the “debtor”. Every person and entity owed something by the debtor is a “creditor”. In this case, PG&E is the debtor, and wildfire claimants are creditors. At the urging of our firm and the rest of the leadership in the state court fire litigation, the U.S. Trustee established an Official Committee of Tort Creditor Claimants (TCC). The TCC represents all wildfire claimants and anyone else with an unresolved tort claim against PG&E.

The TCC is comprised of eleven creditors, including one of our clients. Because we represent this creditor, we sit in a representative capacity on the TCC. We have used this position at every opportunity to advocate on behalf of those who have suffered and continue to suffer at PG&E’s hands. As representative members of the TCC, we have a fiduciary duty to maximize recovery for all of our clients, and for all wildfire claimants, to the greatest extent possible.

In addition to the TCC and the debtor, there are two other major groups vying for control of the case and of PG&E’s assets. The Unsecured Creditor’s Committee (UCC) is comprised of investment banks, other institutional bondholders, and hedge funds that snatched up the bonds that fund PG&E’s normal operations. Under bankruptcy code, the UCC’s claims against PG&E carry the same weight as the TCC’s claims. Our claims do not have legal priority over their claims, and their claims do not have legal priority over our claims. The last major group is the shareholders, who own the hundreds of millions of common shares of PG&E stock. Under bankruptcy code, these so-called equity shareholders are below the TCC and UCC in priority.

At every stage of the bankruptcy, PG&E will, by any means necessary, seek to reduce the amount of overall wildfire claims to preserve the rights of the bondholders and shareholders. The better those groups do in the bankruptcy, the more attractive the new PG&E will be as an investment after it emerges from bankruptcy. That means PG&E will be able to more easily and more cheaply obtain the capital it requires to run its business.

Now that PG&E has secured temporary financing to continue operating the utility while it is in bankruptcy, the next phase is to gather information from all the creditors to determine the value of all creditor claims. This claims process consists of several distinct steps. First, the Court will adopt a “proof of claim” form specifically for the purpose of filing wildfire claims. PG&E’s proposed proof of claim form is long and requires extensive documentation, much of which PG&E burned when it started fires across Northern California. We, along with the TCC, are advocating for a simpler proof of claim form to encourage the participation of as many wildfire claimants as possible.

The Court must also set a “bar date”, which is the date by which creditors must file the adopted proof of claim form in order to preserve their rights against PG&E.

Any wildfire claims not filed by the bar date will be extinguished.

If you believe you or someone you know may have a wildfire claim against PG&E or any tort claim against PG&E, you should contact an attorney as soon as possible. PG&E has asked the Court to set the bar date for September 16, 2019. We have told the Court that September 16 is too soon, given that so many people continue to be without permanent housing or sufficient stability to obtain an attorney.

Once the proof of claim form is adopted and the bar date set, the parties will gather information about the creditor claims in order to determine whether a mutually agreeable reorganization plan may be negotiated to get PG&E out of bankruptcy. This can go a number of different ways – it may lead to a vote by all creditors on “plan confirmation”, where each group of creditors will get to vote to approve or disapprove the plan. If the plan is approved, funds can be put into a trust to begin paying wildfire claims.

If a plan fails to attain the necessary support, the bankruptcy could drag on into a longer process of estimating the value of claims and developing a plan based on the results of that claim’s estimation process. All of the parties have stated publicly that they want to get to resolution as quickly as possible, but we must remain vigilant to hold those accountable, who choose to stand in the way of a fair plan for the benefit of Wall Street or others who are in this process by choice.

Because this is an unusual bankruptcy involving a publicly regulated private utility with billions of dollar in litigation liabilities, it is likely that no deal will get done without the support and backing of government stakeholders in Sacramento, including Governor Newsom and the Legislature. Our office has been working in close coordination with Up From The Ashes, an advocacy group for wildfire victims, to build consensus in Sacramento for a legislative package to help spur resolution of PG&E’s wildfire liabilities. Up From The Ashes has been an invaluable resource in the fight in Sacramento to counterbalance the PG&E’s well-funded lobbying machine, and they need the help of all wildfire victims. If you are looking for a way to get involved directly in these efforts, please go to holdpgeaccountable.com to sign up.

In the meantime, we will continue to extract every advantage we can for our clients and all wildfire claimants. As an example, under tremendous pressure, PG&E has asked the Court for permission to establish an Emergency Fund for the urgent needs of wildfire survivors. This is something that PG&E has done in the wake of past disasters that it caused. Their proposed fund amount of $105 million is obviously inadequate, and we are pushing to increase the funding amount and to implement a process of replenishment of the fund once it is exhausted. If you have any questions about this fund, please contact us.

1/31/2019

PG&E Bankruptcy Update

Bankruptcy moves all fire lawsuits under the federal court overseeing the bankruptcy. The Trustee overseeing the administration of the bankruptcy will be responsible for assigning committees for wildfire claimants and the other creditors owed money by PG&E. These committees will represent the interests of their constituent creditors throughout the bankruptcy proceedings. Your claims will not go away, but they will be taken into consideration alongside those of other significant creditor groups, like PG&E bondholders.

Given the complexity and scope of the fire claims against PG&E, we are working diligently on a plan to administer these claims from a pool of funds. We are working with leadership in the fire cases and skilled bankruptcy lawyers to establish a FIRE VICTIMS CREDITORS COMMITTEE. If such a plan is proposed, each individual claimant will have an opportunity to vote up or down on the proposal. If enough claimants vote for the proposal, the plan will be adopted, and we could have a much shorter road towards recovery. No matter what course the case follows, we will be sure to keep you informed about what is happening and how the unfolding events will impact you.

In the meantime, there are many potential turns the bankruptcy case could take, given the broad powers that the U.S. District Court will have to conduct the bankruptcy proceedings. The Court may hold hearings similar to a civil trial in order to evaluate PG&E’s legal culpability for some or all of the fires. The Court may order additional mediation between the creditor committees and PG&E. The Court could even associate the bankruptcy proceeding with the ongoing criminal probe in federal court.

What we do know is that it is very likely that the Court will authorize a “bar date,” which is a deadline for claimants to file a proof of claim in bankruptcy court. If someone who has suffered losses as a result of a PG&E-caused fire does not file a proof of claim by that date, their rights to recovery for their injuries could be in jeopardy.

For the fire claimants who already have a competent attorney, this is not a major concern. However, for those of your neighbors and loved ones who have been sitting on the sidelines, waiting for news from Cal Fire, keeping an eye on the two-year statute of limitations, or just trying to get their feet under them, now would be a good time to consider retaining a trusted law firm.

Tubbs Fire Investigation

Cal Fire investigators have issued their findings that PG&E infrastructure (poles, wires, fuses, etc.) was not the originating cause of the Tubbs Fire. You may have seen us discussing these issues on TV or in the newspapers. As we have commented on many prior occasions, Cal Fire’s findings and investigative reports are not admissible as evidence in any civil action. The interviews conducted with witnesses, the collection of evidence, and the expert analysis carried out by Cal Fire all may be instructive as we move forward. However, the Cal Fire report itself is neither admissible as evidence nor binding on the court.

The Cal Fire report is eighty pages long. It raises a number of questions that are not answered; however, it does suggest that it was not a PG&E-owned wire that may have touched off the Tubbs fire.

We do not believe the question of who owned the wire is the critical inquiry. Our experts have never seen the Tubbs evidence because Cal Fire has not made it accessible. Regardless of the Cal Fire findings, we believe that PG&E still has responsibility for failing to adopt policies and procedures that would have shut down power proactively given the red flag conditions on the ground in Calistoga that night. These policies and procedures have been adopted with great success in San Diego, and what we know is that these changes would have prevented electrical equipment, regardless of its owner, from starting this fire.

We remain committed to our pursuit of a separate and independent basis for liability against PG&E for the Tubbs Fire, and this report does not change that. To the extent that the cause and origin of the Tubbs fire must be litigated in the bankruptcy court, the evidence and proof will not include direct submission of this report. We remain confident that, when all of the evidence is unearthed and all of the expert testimony is presented, it will be shown that the acts and omissions of PG&E management were responsible, as defined under the law, for causing the Tubbs Fire and its devastation

Unethical Conduct Alert

Over the last forty-eight hours, we have learned that many so-called “advertising” law firms throughout Sonoma and Napa have intensified efforts to sign up clients. Their methods and messages are neither ethical nor honest. Law firms are “cold calling” unrepresented clients and trying to prey upon fears of the Tubbs announcement by suggesting that cases must be filed before bankruptcy (this is not true), declaring that cases must be filed to challenge the Cal Fire determination immediately (not true), or making other statements that engender fear and suggest that clients need to change lawyers in light of the impending bankruptcy, file paperwork, or do other things that are simply not required by law.

We are embarrassed that this is occurring and disappointed that members of the bar would do these things. If you receive a cold call or other solicitation that includes misrepresentations, we recommend that you report the caller to the State Bar of California immediately. The number to call is 800-843-9053.

We have also heard from clients that hedge funds and claims purchasers have appeared on the horizon with the announcement of the bankruptcy. These predators are circling in attempts to take advantage of victims who are short on cash or who may be anxious about recovery in bankruptcy.

Even with the bankruptcy being filed, we believe we will be successful in obtaining recoveries on behalf of our clients. But these hedge funds and claim purchasers know that people are worried, and they want to cash in on this fear. They are looking to buy claims at twenty or thirty cents on the dollar. This is not a good bargain. We have seen letters and emails from settlement advance companies and other entities that want to “immediately purchase fire claims” from attorneys who are handling these cases. When attorneys refuse to make these deals, the next step is always to violate ethical rules and go directly to both unrepresented and represented clients with these dishonest, fearmongering tactics.

The same is true for predatory lenders who may contact you offering to loan you money against your bankruptcy recovery. The usurious interest rates and other unfavorable conditions of these loans make them uniformly bad for the borrower (i.e., you).

The unfortunate reality is that bankruptcy tends to attract these predatory finance companies and law firms, and they recognize that there are many wildfire claimants who are suffering. If you receive these kinds of letters or inquiries, please let us know. You should let anyone who contacts you know that you are already represented by counsel, and if you have friends, neighbors, or acquaintances who are not represented—particularly any who are seriously considering these kinds of offers—let them know that they can contact us for free information and advice about the potential negative consequences. We can answer questions about the bankruptcy process, share what we expect the value of claims to be, and give real-life examples of how these claims purchasers or loan sharks have taken advantage of clients in other cases in bankruptcy.

The silver lining is that Wall Street finance experts would not be buying these claims unless they thought the claims had value—and whatever they are paying for the claims is less than they think they can ultimately get out of the bankruptcy. The question is, how badly are they underpaying? The answer is typically by as much as 30 to 50 percent.

If you have questions about this kind of solicitation, please contact us at (415) 981-7210 or send us an email. We will be happy to answer any questions.

12/11/18

Four Top California Law Firms Begin Filing Series of Lawsuits On Behalf of Camp Fire Victims and Challenge PG&E’s False and Misleading Ads Touting Their Concern for Customer Safety

This is the first and only case filed that directly challenges PG&E for misleading over 16 million customers that safety is its first priority. Two different complaints filed today in Butte County Superior Court are seeking to compensate victims and recoup monies spent by the utility giant for misleading advertising expenditures.

“After the tragedy of October 2017 in wine country, we watched PG&E blanket the airwaves on a daily basis for 14 months advertising that they were interested in the safety of their customers and the prevention of wildfires. All of that money spent on advertising should have been spent on prevention.”

– Mike Kelly of Walkup, Melodia, Kelly & Schoenberger

Read the Full Press Release Here.

11/17/18

CPUC Chief Not Concerned Over PG&E Financial Condition

Speaking to the Sacramento Bee on November 14, California Public Utilities Commission president, Michael Picker, said he does not believe Pacific Gas & Electric is headed toward bankruptcy, despite the threat of billions of dollars in liability from wildfires.

He acknowledged that PG&E’s growing liabilities are a concern and that the state should take additional steps to ensure the utility has continued borrowing ability to permit it to satisfy its debts arising from wildfire losses in both 2017 and 2018.

He said that he has been on conference calls in the last week with utility investors and executives, conveying the message that the PUC and state legislature are working to maintain the utility company’s financial stability. He characterized bankruptcy as “a news media preoccupation.” He acknowledged that PG&E could file for bankruptcy at some point, but thought that was not “something immediate.”

In the short term, Picker suggested that the current priority should be to help PG&E access low-cost borrowing because its borrowing costs affect ratepayers, saying as the cost of borrowing goes up so do people’s rates.

PG&;E’s stock prices have been up and down since the Camp Fire started.

The state Legislature moved this summer to improve PG&E’s financial position by allowing it to borrow money to pay expenses from 2017 fires, and to pass some of those costs on to its customers. The new law also sets up a process to let PG&E pass fire-related costs to consumers for fires sparked after Jan. 1 2019, but doesn’t apply to 2018 fires.

There is an ongoing discussion about the potential ability of the PUC to include 2018 fires when it considers any PG&E requests for rate adjustments. The CPUC. is one of the government agencies tasked with ensuring that investor-owned utilities operate a safe and reliable grid.

On Thursday, November 15, Bank of America Merrill Lynch held an hour-long call for investment clients in which Mr. Picker took part. Praful Mehta, a Citigroup analyst, whose estimates of PG&E liability have been widely cited, said the CPUC’s unusually aggressive effort to show support for the utility indicated the commission’s confidence that other state authorities backed its position. “It was pretty clear that the CPUC statements drove this recovery,” Mr. Mehta said. “I would say that I think the CPUC would not make such bold statements of support without having some form of blessing to back up their statement.”

Questions remain, however, about PG&E’s board and management as an obstacle to reform and improvement of the utility’s safety culture. According to Mr. Picker, the CPUC is broadening an ongoing review of safety at the company to examine “the corporate governance, structure, and operation of PG&E, including in light of the recent wildfires, to determine the best path forward.” Chairman Picker has said that the examination will include looking closely at the company’s board. Six of the utility’s 12 board members have been in place since before the fatal 2010 San Bruno natural gas pipeline explosion in the San Francisco Bay Area. “That’s not a strong message of accountability to the rest of the organization,” Picker said.

CPUC Chair, Picker, stressed he does not want to drive the company into bankruptcy. Any changes, he said, would need to be made carefully and he stressed patience. In an interview reported online, Picker is reported to have commented: “This is like rebuilding the plane while it’s still in flight — you don’t want to crash the plane while you’re trying to make it safer.”

11/13/18

Camp Fire Legal Update:

In less than six days the Camp Fire, in Butte County, became one of the most deadly and destructive electrically triggered wildfires in California history. Based upon preliminary information, including reports filed by PG&E, it appears that the fire started early on Thursday, November 8, 2017, east of Paradise, California. The number of dead has reached at least 42. As of November 12, there were still 200 people unaccounted for. The fire also displaced individuals and families from more than 6000 homes. The fire incinerated homes, apartments, storage facilities, businesses, hospitals, government buildings, crops, and forest land. In the first five days of its existence, the fire burned over 113,000 acres and destroyed over 6,700 structures.

Origin:

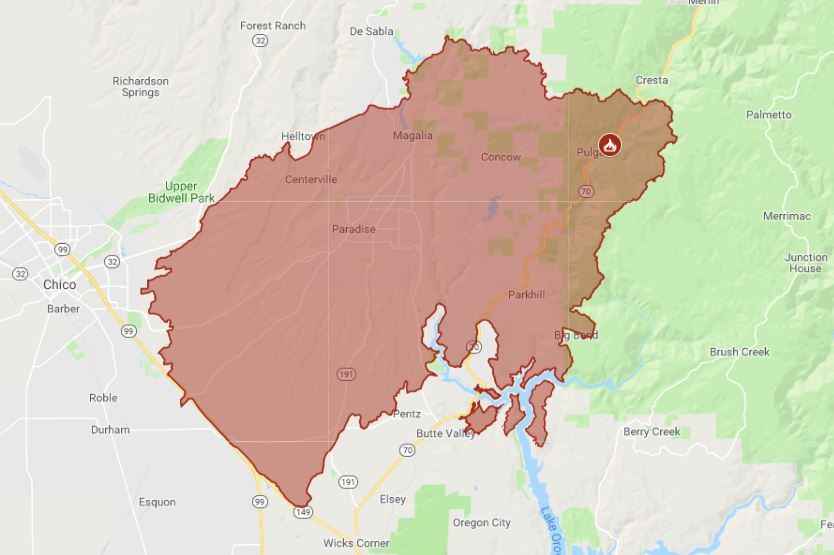

The origin point for the Camp Fire is in the general area of Camp Creek and Pulgas Road, on the northern hillside above the Poe Dam near Highway 70.

The illustration below shows the approximate origin point of the fire, and the perimeter of the fire and its vast scope as of November 12, 2018.

Fig. 1. Map of Camp Fire.

PG&E and the Cause of the Fire:

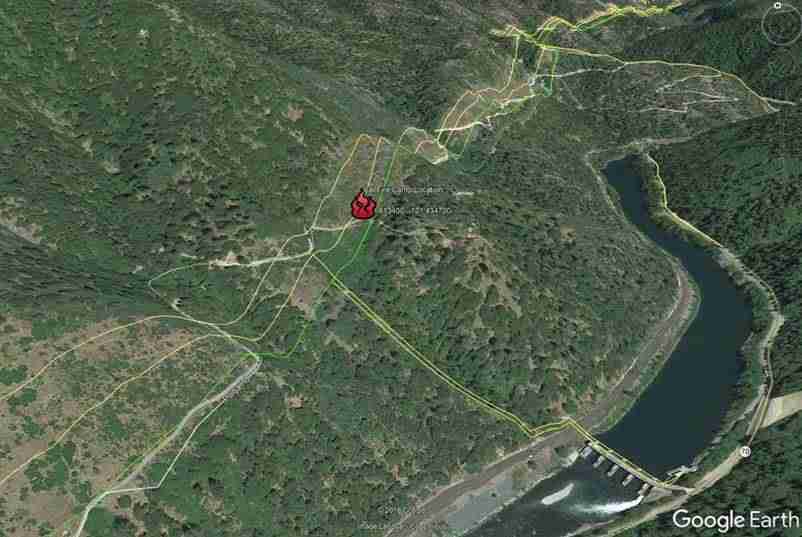

PG&E is already under investigation by the California Public Utilities Commission for their involvement in the origination of this tragic blaze. The Camp Fire started before 6:30 a.m. on Thursday, November 8, 2018. At 6:15 a.m. that morning, PG&E detected a line outage on a 115kV Transmission line above the Poe Dam in Butte County. A subsequent aerial patrol confirmed damage to a PG&E transmission tower on the line roughly one mile north-east of the town of Pulga.

Fire crews were dispatched at 6:33 a.m. and had eyes on the scene by 6:43 a.m. First responders confirmed that power lines were down.

These line outages occurred during a Red Flag event for Butte County. PG&E had already issued multiple alerts that power could be proactively turned off for safety between November 8th and November 9th due to red flag conditions including strong winds and dangerously low humidity. Inexplicably, no power shutdown took place.

Fig. 2. Approximate Origin Point Of Camp Fire

The Walkup Melodia Fire Team Is Involved In The Investigation Of The Camp Fire

When selecting a law firm to represent yourself and your family, you should choose a firm with experience, integrity and track record of success. The Walkup utility-caused wildfire trial team has all those qualities.

Individual team members of the Walkup law firm have close ties to Butte County, with firm family members and friends that have sustained fire-related losses. We understand the issues that are confronting survivors including shock, vulnerability, emotional distress, loss of priceless personal property, loss of homes and businesses.

Walkup has litigated against PG&E for more than 50 years. Senior partner Michael Kelly is one of three lead co-counsel firms appointed to oversee and manage the Northern California wine country fire litigation related to the wildfires that swept through Sonoma and Napa Counties in October 2017, putting the Walkup Melodia team of fire lawyers at forefront of that major fire litigation. We represent more than 200 households and businesses. We understand the issues involved in utility-caused electrical fires.

Contact us for a free initial consultation. We can explain your rights, and answer your questions. Talk to lawyers who are interested in you and your welfare. We are concerned about our clients and have structured our contingent legal fees to be lower than the majority of other firms. We understand the special relationship between attorney and client, and that for many clients the emotional distress that they have suffered as a result of their fire losses is more significant than any property losses. This is an especially traumatic stressful time for those who have lost homes, possessions, jobs, and pets. We are here to help put our clients lives back together piece by piece.

If we cannot help you, or if we do not feel that you have a case we will tell you that. We will not file claims that do not have merit and we will not file claims on behalf of clients we do not believe will benefit from legal representation. Our ultimate goal is to try and restore our clients’ lives back to the condition they were in on November 7, 2018.

We understand how insurers think. We understand how to maximize your recovery.

Contact our firm at (415) 981-7210 or send us an email for a free consultation with an attorney experienced in fire injury litigation.

Resources & Giving:

United Policy Holders – Camp Fire Insurance Claim Help

A California-based non-profit organization, United Policy Holders responds in times of crisis and major disasters. They have developed a comprehensive Roadmap to Recovery to assist fire victims with first steps and long term guidance through the process of navigating the insurance process.

Caring Choices – Emergency Volunteer Center (Chico)

Caring Choices is the designated Butte County Emergency Volunteer Center (EVC) for Camp Fire. They process, vet, and deploy volunteers in response to community official requests.

11/12/18

Investigation of PG&E Liability in “Camp” Wildfire, Paradise, Butte County, CA

“Camp” Fire Wrongful Death Claims

The Walkup Melodia team of fire lawyers is presently involved in the investigation of wrongful death cases against PG&E for the tragic loss of life that occurred in the November 2018 “Camp Fire” that occurred as a result of a PG&E transmission line malfunction, causing widespread devastation throughout Butte County, and devastating city of Paradise together with more than 100,000 surrounding acres. The intense heat of the flames has made it extremely difficult to identify all of those who lost their lives. Many families remain traumatized by the anxiety of not knowing if their loved ones are alive or dead. Sheriff’s deputies and officials from the coroner’s office have been searching charred homes and vehicles that have been too hot for body-sniffing dogs.

As of the writing of this post, authorities have received more than 500 calls about friends and family members who are missing. Fortunately, over 100 missing persons have been located – but many are still unaccounted for. In cases in which missing people are not found alive, some families have been asked to provide DNA samples to help identify the remains, in some cases from bone fragments.

The fire litigation team at Walkup Melodia is available to consult with the victims of the Camp Fire and Paradise tragedy at no charge. Potential clients and surviving family members who want to know their legal rights or discuss the filing and prosecution of a wrongful death claim as a result of a life lost due to PG&E’s negligence should call us at 415-981-7210.

Wrongful Death in Utility-Caused Wildfire

Wrongful death and personal injury claims arising out of utility-caused wildfires are different from property damage claims. Where only property damages are claimed, the injured party can rely upon inverse condemnation and nuisance, two paths to recovery that don’t require the actual proof of a failure to act with reasonable care. However, wildfire-caused wrongful death claims involve different law: clients who have lost a loved one need lawyers who know how to prove the loss of care, comfort, society, financial support and companionship. The law that governs wrongful death cases is different than the law that applies in property loss cases. The items of recoverable damage are different and the proof of losses are different.

When human lives are lost in utility caused wildfires, or victims suffer burn injuries requiring lengthy and painful treatment, physical injury, those who sustained loss or suffered physical injury need law firms and lawyers who have the specialized training and experience to prosecute and try cases in the area of wrongful death and personal injury. This is because financial recovery for wrongful death and personal injury losses arising out of utility-caused wildfires cannot be based on the theory of inverse condemnation or nuisance. Wrongful death and burn injury claims arising out of utility-caused wildfires must be based on negligence or intentional conduct, and the lawyers who prosecute such claims must have a background in the area of negligence and intentional wrongdoing.

Experience in Wildfire Litigation

The wrongful death lawyers of Walkup, Melodia, Kelly and Schoenberger have been successfully recovering money damages for wrongful death and serious burn injury claims for more than 50 years. We understand the elements of damages, how to prove fire-related wrongful death claims and fire-related personal injury claims. We know the fire cause and origin experts to hire, the economic experts to retain in order to prove a financial loss to surviving heirs, the ways to demonstrate a failure of reasonable care on the part of electric utilities.

The lawyers of Walkup, Melodia, Kelly and Schoenberger are currently retained to prosecute more than 20 wrongful death cases arising out of the 2017 North Bay Sonoma/Napa fires and the 2017 Montecito mudslide tragedy, which arose from the deadly Thomas fire.

We are committed to obtaining the maximum amount possible for the survivors of those killed as a result of wildfire-caused injuries.

We know the pain that occurs when a family loses a father, mother, son, daughter, aunt, uncle or grandparent. We have obtained multimillion-dollar settlements and verdicts for the loss of family members in wrongful death cases. Our team has achieved successful wrongful death outcomes in mediation, arbitration and jury trials. The Walkup Melodia wrongful death group knows how to prove negligence on the part of utilities that cause death. Call us today for a free consultation at 415-981-7210.

11/7/18

First Bellwether Trial Set In Northern California Wildfire Cases

In a Case Management Order (number four) issued on Friday, November 2, 2018, Judicial Council case management trial judge, Curtis Karnow, issued his decision setting the “Atlas fire” for trial in the fall of 2019. In making his ruling, Judge Karnow wrote:

“Three proposals have been made for the first fire to go to trial: Atlas, Tubbs, and Sulfur. There are two competing general interests here: first, the goal is to have a trial which includes a sufficient number of issues such that the verdict, in that case, will be persuasive for not only the other parties involved in that fire but also will be seen as strongly predictive of the way issues are likely to be resolved the cases involving other fires……”

PG&E suggests the Tubbs fire. Most plaintiffs groups including plaintiff leadership recommend the Atlas fire. Tubbs is the most complex and wide-ranging case to try. The Tubbs fire may have more points of origin than the Atlas fire, which may exponentially increase the number of pertinent experts needed, and to the extent that a plaintiff’s damages were arguably caused by more than one point of ignition, may generate complexities not found in a simpler case. The Cal Fire report is not available for Tubbs, although it is available for the Atlas fire, suggesting that discovery could proceed more expeditiously for the Atlas fire….. Even if there is only one ignition source for Tubbs, the means of ignition for the Tubbs fire appears at this time to be under serious debate, potentially involving both PG&E actions and inactions, as well as those of private parties. For Tubbs, the specific disagreement on who is responsible for the ignition apparently will not relate to the theories presented by other cases. By contrast, the Atlas fire appears at this time to be tree-line contact case with one or at most two points of ignition but in each case with a similar mechanism. This suggests a somewhat simpler causation analysis for the Atlas fire, and one which may be common to the other fires. The Atlas fire includes a very substantial number of parties and structures, which will make it useful as a precedent. We will try the Atlas fire first”

Judge Karnow’s decision to set the Atlas fire for trial first will not impair or negatively affect efforts to do the necessary “discovery” on all the fires involved in the October 2017 inferno. Indeed, whether or when to try and begin settlement talks is entirely up to PG&E. For that reason, we are prepared to participate in “bellwether trials” in all fires if necessary. At the same time, it is hoped that as trial preparations unfold and PG&E internal documents are produced, and depositions of relevant PG&E witnesses and experts are completed, PG&E will adopt a less contentious attitude and decide to discuss case-by-case resolutions.

A copy of the entire court order issued by Judge Karnow now is available here. North Bay Fire Cases Order #4

Interestingly, just three days after Judge Karnow’s ruling, in a call with bankers and shareholders, PG&E’s CEO, Geisha Williams, said in a live-streamed quarterly earnings report that the state’s liability policy is “flawed and it needs to be addressed,” repeating a contention she had made previously when PG&E was lobbying the legislature to abolish inverse condemnation liability. Williams ignored discussion of recent changes in California law that were enacted to give PG&E precedent-setting relief, allowing it for the first time to tap ratepayers for a portion of last year’s wildfire costs. Under the new legal rules, the California Public Utilities Commission was ordered to apply a financial “stress test” determining the specific amount PG&E can pay without harming ratepayers or affecting power service. PG&E can then seek to recover any additional amounts it must pay through sales of state-sponsored bonds, which will be repaid by the utility’s customers through charges on their monthly bills.

State Sen. Bill Dodd, a Napa Democrat who co-chaired the wildfire legislation committee, was quoted in the Santa Rosa Press Democrat after Williams’ shareholder’s presentation as saying: “PG&E needs to be focused on improving the way it operates and meeting its duties under current law, especially newly required wildfire mitigation plans.”

Referring to PG&E’s desire to have inverse condemnation liability eliminated, Dodd continued: “The courts and the Legislature declined to change inverse condemnation this year, and I don’t see why that would be different next year.”

June 8, 2018

Press Conference on Cal Fire Report & PG&E Negligence

In the video below, one of our Wildfire Victim Advocate Consortium partners, Frank Pitre, leads a press conference discussing Friday’s Cal Fire report on the causes of 12 of the 2017 Northern California wildfires and speaks in detail regarding the directly related PG&E negligence.

June 8, 2018

Additional Cal Fire Reports Released – PG&E Blamed for 12 Nor-Cal Wildfires

Cal Fire announced today “after extensive and thorough investigations” that 12 of the Northern California Wildfires were caused by “electric power and distribution lines, conductors and the failure of power poles.” The 12 fires referred to in the report are the Redwood, Sulphur, Cherokee, Blue, Norrbom, Adobe, Partrick, Pythian, Nuns, Pocket, Atlas and “37” Fire in Sonoma County. The report goes into detail regarding the cause of each fire.

Cal Fire investigations will continue and additional reports will be released as they are compiled. The report on the Tubbs Fire, one of the most devastating, is still forthcoming. California state senator, Jerry Hill, who represents San Bruno, where the PG&E explosion killed eight, had already stated the intention to break up the utility if Cal Fire blames the North Bay wildfires on PG&E negligence.

PG&E issued a press release in response to Cal Fire’s announcement, saying that the company still maintains that its “overall programs met our state’s high standards.” They also referred in the release to a “new normal” that requires new solutions. PG&E has already been the focus on more than 100 lawsuits related to the fires and some are speculating whether the utility can withstand the financial hit, if held responsible for additional fires, such as the Tubbs fire.

According to the report, Cal Fire’s investigations have been referred to the appropriate county District Attorney’s offices for review.

Read the Cal Fire report here.

May 25, 2018

First Cal Fire Reports Released – Sonoma & Napa County Expected Soon

Cal Fire released a report today that found PG&E power lines were responsible for four Northern California wildfires in Butte and Nevada Counties last October. Investigations into three of those four fires found evidence that PG&E had violated Public Resources Code Section 4293 and may be held criminally liable for its failure to manage vegetation in the proximity of the power lines they manage.

No official causes have been announced in the contemporaneous fires that devastated the North Bay region yet, including the Atlas, Tubbs, Nuns, Redwood Valley, Cascade, Sulphur and Pocket fires. Cal Fire is likely to announce those officials reports in the coming weeks. Like the Butte and Nevada County fires, many clues suggest that PG&E power lines and other equipment buffeted by heavy winds also caused or contributed to the most costly firestorm in California history.

On October 8, during a wind storm where gusts hit hurricane levels, several fires kicked up throughout the North Bay Region. More than 40 people died, hundreds were burned or injured, thousands were displaced, and over 10,000 homes and structures were lost. Soon after the fire, it became clear that there was no singular or dominant cause, and that it would take time to complete the investigation. But even in those early days, the San Francisco Chronicle reported that “power lines, like the ones laying amid burned branches and grass at some of the suspected origin points in Napa and Sonoma counties, can start fires in a variety of ways.”

Later, in February, The Press Democrat reported that “Santa Rosa city fire investigators have determined that PG&E power lines buffeted by heavy winds the night of Oct. 8 ignited at least two small fires in city neighborhoods”, and that “the fire damage to the site was a direct result of the high winds causing the power lines to arc, starting a fire in the combustible vegetation.” In March, the San Francisco Chronicle further reported that, “in the months since the fires erupted, no evidence has emerged in public pointing to any explanation other than power lines swaying, arcing and falling in the wind.”

Although a source for the fires in Sonoma and Napa Counties have not been announced yet, the likelihood that PG&E equipment and procedural failures caused most or all of the fires prompted thousands of lawsuits that have been consolidated into a coordinated litigation led by our firm, Walkup Melodia Kelly & Schoenberger, and the Cotchett, Pitre & McCarthy LLP and Robins Cloud LLP law firms. PG&E has a past history of failing to properly maintain its equipment and siphoning away money from maintenance into profits. We suspect that PG&E is responsible for these fires, and we will know soon what Cal Fire determines caused them.

Click here to read the Cal Fire News Release

May 25, 2018

Liability Discovery Efforts Underway

Walkup Melodia, in association with our consortium partners, Abbey, Weitzenberg, et. al., Cotchett, Pitre, & McCarthy LLP, Panish Shea & Boyle LLP, Dreyer Babich Buccuola Wood Campora LLP, have started the process of obtaining information from PG&E through the discovery process. We have sent deposition notices and requests for production of documents and electronically stored information that we expect to contain millions of pages related to PG&E’s compliance and safety record. These records will show the degree with which PG&E complies with state liability law, published vegetation management plans and programs, and their own internal safety guidelines. Simultaneously, our experts and investigators are inspecting physical evidence collected in connection with the fires, and we are hard at work evaluating the impact and losses suffered by North Bay residents and businesses.

May 24, 2018

PG&E’s Bid to Avoid Inverse Condemnation Liability Rejected

On May 22, 2018, Superior Court Judge Curtis E.A. Karnow, the San Francisco-based trial judge overseeing the coordinated California North Bay Fires litigation, rejected PG&E’s plea to drop inverse condemnation liability claims – an important step on the path to fair compensation under constitutionally protected eminent domain principals.

PG&E’s lawyers argued that, “regardless of [even the] most egregious fault . . . unless PG&E has an absolute insurance policy from the CPUC, and is absolutely 100% guaranteed reimbursements, [victims] cannot have inverse condemnation.” However, the judge concluded that “it is not arbitrary or irrational to require a privately owned utility, which has been granted a monopoly or quasi-monopoly status by the state and which is authorized to pass its costs to its ratepayers upon satisfying a prudent manager standard, to pay property owners for the damages caused by its instrumentalities.”

Order Overruling PG&E’s Demurrers: Click here to read the court order.

March 29, 2018

PG&E Execs Get Millions In Bonuses While Seeking To Pay Homeowners Nothing

In mid-March, we learned that PG&E was engaged in an expensive and comprehensive “backroom politics” campaign lobbying California state legislators to change current liability laws to immunize PG&E from responsibility in the North Bay firestorms. PG&E is seeking financial immunity from the state legislature, a change in the law of inverse condemnation, and the creation of liability hurdles to make it impossible for homeowners to be made whole.

The California Constitution provides that where a public utility takes property without just compensation, it is liable under the doctrine of inverse condemnation. PG&E is seeking to overturn that law.

PG&E went to Sacramento and floated an analogy to legislators that “if a drunk driver hits a utility pole, and the utility wire drops to the ground and starts a fire, then PG&E is unfairly liable for inverse condemnation”. That false premise struck a sympathetic chord with some legislators. But the analogy is wrong.

Although final reports of investigative agencies have not yet been issued, it is clear that the North Bay fires did not happen as the result of a drunk driver. The truth is that PG&E did not follow its own internal guidelines for line maintenance, recloser performance, vegetation management, and a host of other safety-related mandates. PG&E failed in its obligation to be safe.

March 13, 2018

SAN FRANCISCO: Wildfire Victim Advocates Attorneys Michael Kelly & Frank Pitre Named Co-Lead Counsel In California North Bay Fires Litigation

Wildfire Victim Advocates legal group proudly announces attorneys Michael Kelly of Walkup, Melodia, Kelly & Schoenberger and Frank Pitre of Cotchett, Pitre & McCarthy LLP have been named as Co-Lead Counsel, representing thousands of individual plaintiffs filing lawsuits against Pacific Gas & Electric Company and PG&E Corporation as a result of the North Bay Fires. The appointment was made following the first case management hearing in San Francisco Superior Court on Tuesday, February 27 and signed by Judge Curtis E.A. Karnow on March 6, 2018.

“It is an honor to be placed in a position of such responsibility,” said Kelly. “The damage, loss, and harm our friends and neighbors have endured as a result of the North Bay Fires has been catastrophic and we’re ready to get to work, moving the claims for damage from all of the PG&E originated fires to resolution. Our goal is justice for the victims and the survivors.”

Serving as Co-Lead Counsel with Kelly and Pitre is Bill Robins III of Robins Cloud LLP. Together, these three head a team of more than 30 firms who will be responsible for overseeing and coordinating all pretrial activities in the complex litigation, including the briefing, filing and arguing of motions, taking all discovery, as well as appearing before the court at all court-ordered proceedings and presenting cases at trial for the individual plaintiffs.

Attorney Khaldoun Baghdadi with Walkup, Melodia, Kelly & Schoenberger, and Wildfire Victim Advocates was also appointed to serve as Plaintiffs’ Co-Liaison Counsel along with Amy Eskin of Levin Simes LLP and Steven Skikos of Skikos, Crawford, Skikos & Joseph LLP. Their responsibilities include receiving and distributing orders, notices and correspondence from the court to plaintiffs’ counsel, as well as maintain and make available a complete set of all filed pleadings and orders filed and/or served in the coordinated proceedings.

In addition, Wildfire Victim Advocates attorneys Brian Panish and Rahul Ravipudi of Panish Shea & Boyle LLP, Steve Campora of Dreyer Babich Buccola Wood Campora LLP, as well as Brendan M. Kunkle and Michael Green of Abbey, Weitzenberg, Warren & Emery, have been named members of the Plaintiffs’ Executive Committee. Members of this committee will, along with other responsibilities, coordinate pretrial activities and work performed by lead counsel and liaison counsel as well as call meetings and consult with individual Plaintiffs’ counsel on matters of common concern.

The North Bay Fires started when electrical equipment owned and maintained by Pacific Gas & Electric (PG&E) came into contact with vegetation and/or other equipment owned and maintained by the utility, all because of PG&E’s alleged disregard of mandated safety practices and the foreseeable risks associated with failure to reasonably manage its infrastructure. As a result of the North Bay Fires, at least 43 people were killed, many others injured, more than 14,700 homes were destroyed and over 245,000 acres burned throughout California’s Wine County.

The Judicial Council Coordination Proceeding is being heard in the Superior Court of California, County of San Francisco. (California North Bay Fire Cases (JCCP No. 4955))

If you or someone you love has been affected by the North Bay Fires – including the Tubbs, Atlas, Nuns, Oakmont, Adobe, Norrbom, Partrick, Redwood, Pressley, Sulphur and Pocket fires – please call our Wildfire Victim Advocates attorneys at (707) 658-4415 to schedule a free consultation and discuss your legal options.

Residents of Northern California, Including Santa Rosa, Napa, Sonoma & Calistoga

We are already representing clients throughout the fire-ravaged counties. With our local partners in Santa Rosa, the Walkup Law Firm Fire Litigation Team has filed lawsuits against Pacific Gas & Electric for injuries, damages, and losses that have occurred in Sonoma County, Napa County, Solano County, Lake County, and Mendocino County. The Walkup Wildfire Legal Team is representing victims who suffered personal injury, wrongful death, and substantial real property losses.

By Order dated January 4, 2018, all filed cases will be consolidated in a San Francisco Superior Court Judicial Council Coordinated proceeding (click here to read the court order). This includes all cases for clients who lost homes, businesses, ranchland, and undeveloped real property in Calistoga, Kenwood, Santa Rosa, Sonoma, Napa, Solano County, Mendocino, Lake County, Fountain Grove, Coffee Park and unincorporated areas throughout Napa County.

The Walkup Fire team represents, and/or has filed lawsuits on behalf of, clients who sustained burn injuries in the Tubbs Fire, Nuns Fire (includes Adobe, Norrbom, Pressley, Partrick, and Oakmont fires), Atlas Fire, Potter/Redwood Fire, Sulphur Fire, and Helena/Fork Fire. We have also filed wrongful death cases and we represent the survivors of people who died in the fires.

Beyond fire-related injury and wrongful death lawsuits, we are honored to have been retained by property owners to recover on their behalf for emotional distress and uninsured financial losses to homes, wineries, growing crops, business structures, landscape, ranchland, and significant historic trees.

We are representing property owners who have lost property in the Tubbs Fire, Nuns Fire, Atlas Fire, Potter/Redwood Fire, Sulphur Fire, and Helena/Fork Fire.

Our team is working with clients to maximize their insurance policy recoveries while also advising them on dealing with issues surrounding the process of rebuilding or relocating, depending upon their needs.

If you, a friend or a family member, have sustained significant losses from the terrible October 2017 wildfires in Sonoma, Napa, Lake and Mendocino counties which will not be covered by insurance for such things as increased costs of construction, uncovered cost of rebuilding, uncovered losses of personal property, including items of special sentimental value, lost business opportunities, lost wages, and other financial losses, call the Northern California Wildfire Litigation Team at Walkup Melodia. Our team of lawyers is headed by managing partner Michael A. Kelly, partners Khaldoun Baghdadi, Doris Cheng, and Sara Peters and associate Andrew McDevitt, together with a supporting crew of dedicated paralegals and legal assistants.

We have a 60-year history of professionally serving our clients throughout the bay area. Our lawyers are consistently ranked by neutral rating services as the best of the best-check our ratings on BestLawyers.com and SuperLawyers.com. We recommend that potential clients check with lawyers and judges in Napa, Sonoma, Marin and San Francisco. Ask about our historical track record ethics and integrity. Ask about our superior record of recovering money for our clients. Check out what our clients say about our professionalism and dedication on YELP. We are confident that clients who ask for referrals or confirmation from local lawyers and judges will be encouraged to work with our team.

LITIGATION UPDATES ON SELECTED WILDFIRES

Tubbs Fire Litigation Update

Atlas Peak Fire Litigation Update

Nuns Fire Litigation Update

WALKUP MELODIA MAP of PG&E INCIDENTS

WHY WALKUP MELODIA IS THE RIGHT FIRM FOR THESE CASES

When selecting a law firm to represent yourself and your family, you should choose a firm with experience, integrity and track record of success. The Walkup fire trial team has all those qualities. Members of the Walkup firm have close ties to the Sonoma and Napa valleys, with firm members and family members who have themselves sustained fire-related losses in the October 2017 conflagration. We understand the issues that are confronting survivors including shock, vulnerability, emotional distress, loss of priceless personal property, loss of homes and businesses.