Camp Fire Origins

In less than six days the Camp Fire in Butte County, became the most deadly and destructive electrically triggered wildfire in California history. Based upon preliminary information, including reports filed by PG&E with the CPUC, the fi restarted early on Thursday, November 8, 2018, east of Paradise. The number of deceased exceeds 56 people and is climbing. There are still people unaccounted for. The fire has destroyed more than 8,750 homes. The fire incinerated homes, apartments, storage facilities, businesses, hospitals, government buildings, crops and forest land. In the first six days of its existence, the fire-burned over 140,000 acres and destroyed over 9,000 structures.

Origin:

The origin point for the Camp Fire is in the general area of Camp Creek and Pulgas Road, on the northern hillside above the Poe Dam near Highway 70. The illustration to the right shows PG&E’s transmission lines in relation to where the fi restarted.

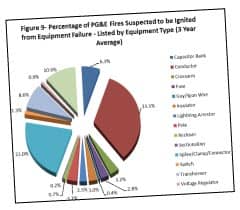

PG&E and the Cause of the Fire:

PG&E is under investigation by the California Public Utilities Commission for their involvement in the origination of this tragic blaze. The Camp Fire started before 6:30 a.m. on Thursday, November 8, 2018. At 6:15 a.m. that morning, PG&E detected a line outage on a 115kV transmission line above the Poe Dam in Butte County. A subsequent aerial patrol confirmed damage to a PG&E transmission tower on the line roughly one mile northeast of the town of Pulga. Fire crews were dispatched at 6:33 a.m., and had eyes on the scene by 6:43 a.m. First responders confirmed that power lines were down. These line outages occurred during a red flag event for Butte County. PG&E had already issued multiple alerts that power could be proactively turned off for safety between November 8th and November 9th due to red flag conditions including strong winds and dangerously low humidity. Inexplicably, no power shutdown took place.

Walkup Melodia Is Involved in Investigation of the Camp Fire

When selecting a law firm to represent yourself and your family, you should choose a firm with experience, integrity and a track record of success. The Walkup utility-caused wildfire trial team has all those qualities. We understand the issues that are confronting survivors including shock, vulnerability, emotional distress, loss of priceless personal property and loss of homes and businesses.

Walkup has litigated against PG&E for more than 50 years. Senior partner Michael Kelly is one of three lead co-counsel appointed to oversee and manage the Northern California wine country fire litigation related to the wildfires that swept through Sonoma and Napa Counties in October 2017, Mr. Kelly’s leadership role put the Walkup Melodia team of fire lawyers at the forefront of that major fire litigation. We understand the issues involved in utility-caused electrical fires.

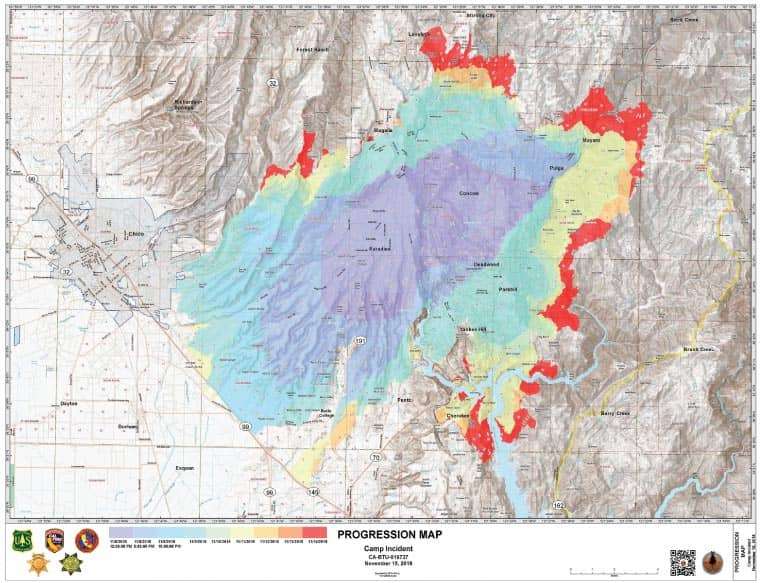

Extent of Camp Fire as of 11/15/18

We can explain your rights, and answer your questions. Talk to lawyers who are interested in you and your welfare. We are concerned about our clients and have structured our contingent legal fees to be lower than the majority of other firms. We understand the special relationship between attorney and client, and that for many clients the emotional distress that they have suffered as a result of their fire losses is more significant than any property losses. This is an especially traumatic and stressful time for those who have lost homes, possessions, jobs, and pets. We are here to help put our clients’ lives back together piece by piece. If we cannot help you, or if we do not feel that you have a case we will tell you that. We will not file claims that do not have merit and we will not file claims on behalf of clients we do not believe will benefit from legal representation. Our ultimate goal is to try and restore our clients’ lives back to the condition they were in on November 7, 2018. We understand how insurers think. We understand how to maximize your recovery.

Contact our firm at (415) 981-7210 for a free consultation with an attorney experienced in fire injury litigation or visit our website: www.walkuplawoffice.com

Wrongful Death Lawyers for Death from Wildfires

Wrongful death and personal injury claims arising out of utility caused wildfires are different from property damage claims. Where only property damages are claimed, the injured party can rely upon the legal theories of inverse condemnation and nuisance, two paths to recovery that don’t require the actual proof of a failure to act with reasonable care. Clients who have lost a loved one need lawyers who know how to prove the loss of care, comfort, society, financial support and companionship.

When human lives are lost in utility-caused wildfires, or when victims suffer burn injuries requiring lengthy and painful treatment, those who sustained loss or suffered physical injury need law firms and lawyers who have the specialized training and experience to prosecute and try cases in the area of wrongful death and personal injury. This is because financial recovery for wrongful death and personal injury arising out of utility-caused wildfires must be based on negligence or intentional conduct, and the lawyers who prosecute such claims must have a background in the area of negligence and intentional wrongdoing.

The wrongful death lawyers of Walkup, Melodia, Kelly and Schoenberger have been successfully recovering substantial jury verdicts and settlement awards for wrongful death and serious burn injury claims for more than 50 years. We know the fire cause and origin experts to hire and the economic experts to retain in order to prove financial loss to surviving heirs. We understand the ways to demonstrate a failure of reasonable care on the part of electric utilities.

The lawyers of Walkup, Melodia, Kelly and Schoenberger are currently retained to prosecute more than 20 wrongful death cases arising out of the 2017 North Bay Sonoma/Napa fires and the 2017 Montecito mudslide tragedy, which arose from the deadly Thomas fire.

We are committed to obtaining the maximum amount possible for the survivors of those killed as a result of wildfire-caused injuries.

We know the pain that occurs when a family loses a father, mother, son, daughter, aunt, uncle or grandparent. We have obtained multimillion-dollar settlements and verdicts for the loss of family members in wrongful death cases. Our team has achieved successful wrongful death outcomes in mediation, arbitration and jury trials. The Walkup Melodia wrongful death group knows how to prove negligence on the part of utilities that cause death.

Frequently Asked Fire-Related Questions

Below are answers to frequently asked questions designed to help our neighbors who have been devastated by these fires. We also have decades of experience dealing with insurance carriers, and we want to provide pro bono (free) guidance to those who want to understand their insurance rights. Please feel free to use the information below, and also to call or email us for a free review of a particular homeowner’s policy. There are no strings attached, and no contracts or fees required. If you want to speak with a lawyer about your homeowners’ policy, call (415) 981-7210 and state that you are seeking pro bono advice on your fire insurance benefit.

Are there timing issues I need to be aware of? Yes. You should make a claim under your insurance policy as soon as possible in order to comply with your policy’s notice requirements. You should also cooperate with your insurance agent, and check in with them to make sure you are aware of all applicable deadlines. Most policies require the insured to notify the insurer “as soon as practicable” after the loss.

Even though you may be reeling from the harm this fire has caused, these first couple of months are an important time to enlist help from family and friends to recall and prove the items you lost so that you are not short changed.

What are the different types of coverage I am entitled to in my homeowner’s (fire insurance) policy?

A typical homeowner’s (fire insurance) policy provides four property loss coverages:

Coverage A: Dwelling (insures the residence)

Coverage B: Other Structures (workshops, detached garages, etc.)

Coverage C: Personal Property (items within your home, in your car, on your property, and in other structures)

Coverage D: Loss of Use (includes ALE [additional living expenses] and Fair Rental Value for residences that were used as rental properties)

How much should fire insurance pay for my home?

There are three types of Replacement Cost Coverage: (1) Guaranteed Replacement Cost (not limited by any policy limits), (2) Extended Replacement Cost (limited by stated policy limits + stated percentage increase, or increases), and (3) Replacement Cost (limited by stated policy limits).

Most policies are written with Extended Replacement Cost coverage. Your policy and Declarations Page may state a percentage or percentages that you can use to increase (or extend) your insurance coverage. This is typically 10% – 50%. For example, if you have a $500,000 policy limit, with a 50% extension ($250,000), your policy will provide up to $750,000 to pay for rebuilding your home.

What are my insurance carrier’s obligations?

Your insurance carrier owes you a fiduciary duty to act in good faith and to treat your interests as equal to (or more important than) its own. Also, courts will interpret the insurance policy language “against the drafter” (meaning against the insurance carrier and in your favor, in the case of ambiguity).

Additionally, there are Insurance Code statutes that provide minimum standards any policy of fire insurance needs to meet.

Every insurer must, within 40 days of a receiving a claim, deny or accept it, in whole or in part. It must do so in writing, and give the basis for any denial. If it needs more than 40 days, it must let you know why and provide written notice every 30 days thereafter. Finally, the carrier has to let you know, at least 60 days prior to a deadline, of any statute of limitation or other deadline the insurer may rely on to deny a claim. (Standards for Prompt, Fair and Equitable Settlements (10 Calif. Code Reg. Sec. 2695.7 (b)-(f).)

Many Californians who have lost their homes to fires come to find that they are severely underinsured. Insurance agents and brokers have a responsibility to provide accurate information in their dealings with you, and their failure to do so may lead to liability. For example, if your insurance limits were lowered, or your policy was changed from a guaranteed policy to an extended coverage policy without adequate notice to you, you may be able to revert back to a guaranteed policy. (See Ins. Code Sec. 678(a)(1)(A) requiring that the insured be notified of any “reduction of limits or elimination of coverage.”)If you suspect your carrier is trying to low ball you on the benefits available under your policy, or delay payment of the benefits, you should not accept this without questioning it. You should discuss your benefits with a lawyer.Does fire Insurance cover physical or emotional Injury or wrongful death claims?

Fire insurance does not cover or pay for burns, physical injury, emotional distress or wrongful death. For families who have sustained these losses, retaining a lawyer is key. A respected and experienced personal injury law firm with a long and successful history of practicing law in Northern California is key if you have suffered these types of losses. We urge you to do your own research and to consult with any lawyers you may know regarding the track record and success of Walkup Melodia. Do not be fooled by out-of-town advertising lawyers who seek your trust through gimmicky campaigns.

I have insurance – Do I need a lawyer?

For most of you affected by the fire, your fire insurance will be inadequate to fully compensate for your losses. Fire insurance has limits and conditions. Your available policy limits may be inadequate to rebuild. Not all policies include code upgrade coverage which increases the cost of any rebuilding. Some victims want to rebuild in other states or cities. Contents coverage often does not cover treasured items of family history. Many policies exclude or place significant limits on personal property, including jewelry and art. All policies restrict recovery for replacing landscaping, trees, shrubs and irrigation systems. Many policies exclude coverage for home businesses that sustain financial losses. For rural victims, their existing water systems and septic systems may require upgrades not covered under their policies, making rebuilding even more difficult. Expenses for temporary substitute housing are insufficient in many policies to cover a rebuilding timeline longer than one year.

650 California Street, 26th Floor

San Francisco, CA 94108

Tel: 415-981-7210, Fax: 415-391-6956

www.WalkupLawOffice.com • www.CampFireLawsuit.net

When Wildfire Strikes, Select the Right Lawyers

Do Not Fall Prey to Mass Advertisers, Billboards, or Unwanted Junk Mail

We were offended and apologize for those members of the legal profession who have bombarded victims with marketing and advertising in emails, newspaper ads, billboards, and seemingly endless cards and letters. Reports of unscrupulous people posing as wildfire experts or claims adjusting specialists have surfaced. We are not about high-pressure sales tactics, threats or doomsday sales pitches. We are interested in making sure that our clients are fairly represented and that all avenues of recovery are evaluated and pursued.

We are available to meet at a location convenient to you to discuss representation, including in our local Chico office space. There is no charge for an initial visit or case evaluation. There is no reason for any victim of the fires who has sustained compensable losses to fall victim to marketing schemes perpetrated by case advertising on television or radio – do your homework! Find someone who is referred by a trusted friend or professional. Review the qualifications and competence of the lawyer or law firm. Find out what experience your lawyer has had in the past with the California Courts or the Sonoma and Napa fire litigation against PG&E.

- Check with the State Bar of California. The State Bar has warned the public to watch out for and report potential fraud by persons posing as claim representatives or lawyers.

- Ask for references from Northern California lawyers and judges.

- Ask if the law firm has recent experience and success in litigation against PG&E.

- Check our Walkup Melodia YELP reviews

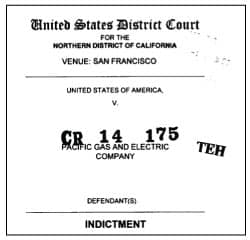

Our Clients Benefit From a Powerhouse Legal Collaboration

Some of the state’s most prestigious law firms have united to form one of the most powerful legal teams ever assembled in order to protect victims in the Camp Fire. Our aim is to ensure that families and businesses affected by these catastrophic fires are treated fairly and that those responsible for their devastating losses are held accountable.

Walkup, Melodia, Kelly & Schoenberger, based in San Francisco, has successfully prosecuted PG&E as a result of transformer fires, power line failures and transformer explosions. Cotchett, Pitre & McCarthy has won numerous multi-million dollar cases against PG&E. and Dreyer Babich Buccola Wood Campora, LLP prosecuted PG&E following the San Bruno Gas Explosion in 2010 that killed eight people and destroyed 38 homes after a natural gas pipeline sent a giant plume of fire into the air. As a result of the explosion, PG&E paid in excess of $2 billion in fines and civil settlements.